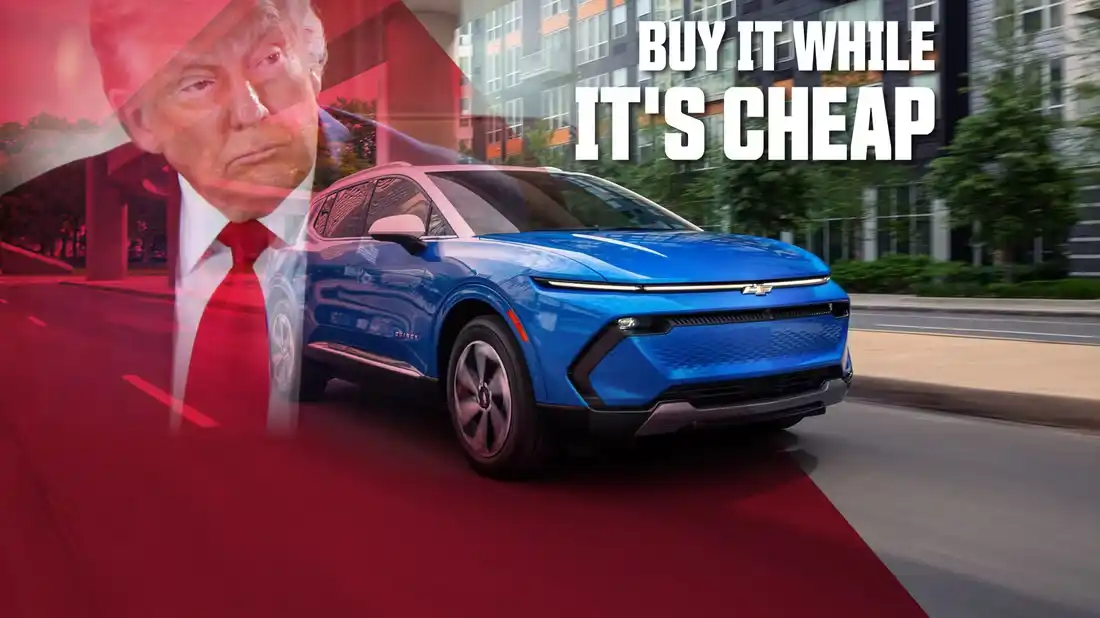

The federal EV tax credit has long been a major incentive for electric-vehicle buyers—but it’s set to expire soon. Under the One Big Beautiful Bill, signed into law by President Trump in July, the $7,500 credit for qualifying new EVs and up to $4,000 for used EVs will be phased out on September 30, 2025. This impending deadline has sparked a rush among buyers, with many racing to secure deals on models like the Chevy Equinox EV before the credits disappear.

Fortunately, there’s a loophole that allows buyers to claim the credit even if their EV isn’t delivered until after the September 30 deadline. According to a recent IRS bulletin, anyone who has a written, binding sales contract and has made a payment before the cutoff date will still qualify for the credit when they take delivery. This means automakers can continue offering the incentive right up until the deadline, though buyers may face longer wait times depending on production schedules. The IRS did not specify any limit on how far out deliveries could be.

Some Real Bargains Available Now

Right now, there are genuine deals for buyers who qualify for the full $7,500 federal tax credit. Take the Chevy Equinox EV, which offers a range of 319 miles and starts at $33,600—after the credit, the price drops to just $26,100. Other standout deals include the Hyundai Ioniq 5 and Kia EV6, sibling models starting just over $42,000, giving buyers a chance to snag high-quality EVs at substantially reduced prices before the credits expire.

The approaching September 30 deadline is driving a surge in EV demand, creating a temporary spike in sales. Once the incentives expire, U.S. EV sales are expected to drop noticeably. While demand has been gradually rising, the removal of these generous credits could even lead to a decline. As a result, many automakers are rethinking their strategies, shifting focus toward hybrid vehicles to better align with market trends.

The federal EV tax credit was first introduced in 2008 under the Energy Improvement and Extension Act. Initially, the credit phased out once an automaker sold 200,000 qualifying vehicles, which meant high-volume manufacturers like Tesla and GM lost eligibility early. The 2022 Inflation Reduction Act overhauled the program, eliminating that cap and adding new requirements related to income, vehicle price, and battery sourcing. Today, buyers can either claim the credit when filing their taxes or transfer it to a participating dealer for an immediate discount at the point of purchase.

Other Incentives: Some Ending, Some Staying

EV owners in 13 states currently benefit from carpool lane incentives in places like Arizona, California, and Georgia, allowing them to bypass traffic and reach their destinations faster. This perk is also set to expire on September 30, alongside the federal tax credit. Lawmakers have proposed the HOV Lane Exemption Reauthorization Act, which would extend EV and alternative-fuel vehicle exemptions through 2031, but its future remains uncertain.

Meanwhile, not all federal support is disappearing. Federal and state incentives for EV manufacturing remain in place, fueling investments like Ford’s new battery plant in Michigan and highlighting the ongoing focus on boosting domestic production.